Ms. Rachel Net Worth in 2026: Estimate and How Rachel Accurso Earns

Ms. Rachel’s net worth is best treated as an estimate, because her income comes from private brand deals and platform revenue that isn’t publicly itemized. Still, based on her massive “Songs for Littles” audience and growing off-YouTube business lines, most realistic public estimates place her in the high single-digit to low eight-figure range.

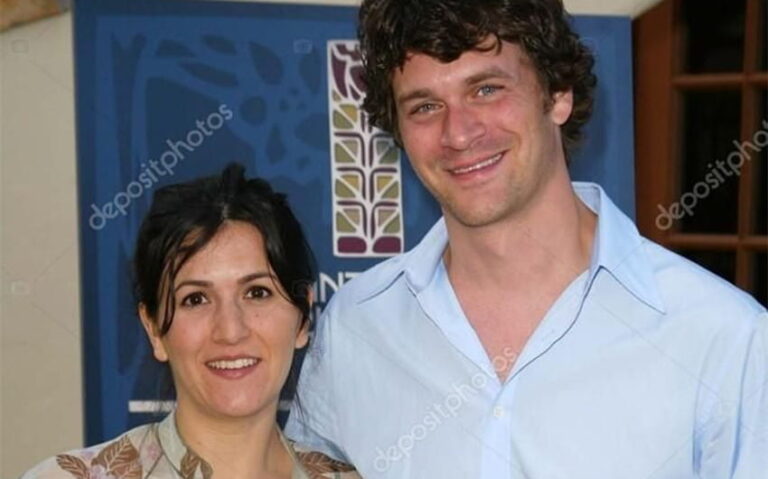

Who Is Ms. Rachel?

Ms. Rachel is the stage name of Rachel Griffin Accurso, an educator and children’s music creator best known for the YouTube series “Songs for Littles”. Her videos are designed for babies, toddlers, and preschoolers, and they’re especially popular with parents looking for language-development and early-learning content that feels gentle, clear, and engaging.

Unlike many internet creators, her brand sits at a rare intersection: she’s both a recognizable on-camera personality and the face of a learning format that families treat like a daily routine. That “routine” factor is what makes her business unusually strong. When toddlers watch the same songs and lessons repeatedly, views accumulate fast—and that kind of repeat viewing is exactly what turns children’s content into a high-earning long-term catalog.

Estimated Net Worth

Most commonly repeated estimates place Ms. Rachel’s net worth around $10 million, with a realistic range of roughly $8 million to $20 million. You may see much higher claims online, but those often assume maximum possible ad revenue every month and treat gross earnings as if they were personal wealth.

A grounded estimate has to account for the fact that:

- YouTube ad revenue varies dramatically by ad rates, season, audience location, and content category.

- Her operation includes production costs, staffing, music creation, equipment, and business overhead.

- “Net worth” is assets minus liabilities, not the same thing as annual income.

So the safest interpretation is that Ms. Rachel is very likely worth eight figures, but the exact number can swing based on how you value her brand, her catalog, and any private deals.

Net Worth Breakdown

YouTube ad revenue from a repeat-watching audience

YouTube is the foundation. Family content can generate enormous view counts because kids rewatch the same videos constantly. That creates steady ad impressions year-round, and her catalog continues earning even when she isn’t uploading daily.

However, it’s important to separate channel revenue from personal wealth. YouTube income typically flows through a business structure that pays for production first. If you’re running a polished children’s channel with multiple performers, editors, and music production, you’re carrying meaningful costs. That’s why “ad revenue estimate” headlines often overstate how much money lands as keepable profit.

Netflix-style distribution and platform expansion

Ms. Rachel’s brand has expanded beyond YouTube into streaming-friendly formats, including compilation-style releases. Even when this kind of deal isn’t a “Hollywood blockbuster payday,” it matters because it adds a second distribution engine. It also makes the brand more durable: if YouTube algorithms change, the audience can still find the content elsewhere.

From a net worth perspective, platform expansion does two things at once. It can add direct licensing income, and it can raise the overall valuation of the Ms. Rachel brand because it looks less like a single-platform channel and more like a multi-platform media property.

Merchandise, toys, books, and brand products

Children’s media becomes truly lucrative when it converts into products. Families don’t just watch—they buy books, toys, and learning materials tied to the character and the routines kids love.

This category can be a powerful wealth driver because it’s scalable. A product line doesn’t depend on uploading new videos every week. If the demand is strong, it can create a steady stream of profit that behaves more like a traditional business than like a creator gig.

That said, product income also comes with complexity: manufacturing, inventory, shipping, returns, licensing partners, and retail splits. The upside is real, but the net profit depends heavily on how the deals are structured and how efficiently the business is run.

Music revenue from streaming and children’s catalogs

Ms. Rachel’s content is music-heavy, and children’s music can generate meaningful income over time through audio streaming platforms and licensing. The key advantage is durability. Nursery rhymes and early-learning songs don’t “go out of style” the way trend-driven pop can. Parents constantly search for the same themes—bedtime, emotions, routines, counting, colors—and that keeps plays consistent.

Even if music is not the largest slice compared to YouTube and products, it can function as a reliable supporting stream that adds stability to yearly earnings.

Live shows and appearances

When a children’s creator becomes big enough, live events can become a serious business. Ticket sales, VIP packages, venue splits, and merchandise on-site can add up quickly, especially in major markets.

Live income can be especially valuable because it tends to be more “cash-like” than catalog earnings. But it also comes with touring costs: venues, staff, travel, insurance, production, and scheduling. In other words, live shows can boost annual earnings meaningfully, but they’re not pure profit.

Sponsorships and brand partnerships

With a trusted, parent-facing brand, sponsorships can be a major revenue lane. Brands pay a premium when the audience is both large and highly targeted, and parents of toddlers are one of the most valuable consumer segments in advertising.

Partnership value depends on how selective the brand is. If sponsorships are limited and carefully chosen, the fee per deal can be higher and the brand trust stays intact—both of which support long-term net worth growth.

What reduces the net worth number: overhead, taxes, and reinvestment

Ms. Rachel’s business almost certainly has substantial overhead compared to a solo creator filming in a bedroom. Music production, filming, editing, costumes, sets, performer pay, and day-to-day operations all cost real money. Add professional services (legal, accounting, management) and you’re looking at a serious operation.

Then there’s taxes. High income in the U.S. is heavily taxed, and business income can create additional complexities depending on how it’s structured. Many creators also reinvest aggressively—new episodes, better production, larger teams—because reinvestment is how a channel becomes a long-term media company.

Featured Image Source: https://www.buzzfeed.com/stephaniesoteriou/ms-rachel-praised-billionaires-comment